We all are well aware of the notion of a mortgage from our own individual incidents. The mortgage situation arises when some people cannot afford to purchase a residence outright due to insufficient funds in their bank account, so they go to financial institutions such as a bank for the purpose of the loan. And when the bank agrees to give them a loan with the condition that the property can be lawfully reclaimed and sold to pay off the loan’s balance if the borrower is fined on their fees.

So this was the basic idea for the mortgage, but this is not it. A mortgage is a broad concept, and there are many different fields connected to it; if you are seeking mortgage assignment help, you are at the right place.

An assignment on a mortgage consists of a multi-level process. You just can’t start with one aspect and keep writing on that. There’s a lot to do while writing an assignment of mortgage. And that’s why it has become a necessity for students to seek mortgage assignment help from a subject matter expert.

A Complete Overview of the Topic for Your Mortgage Assignment Writing Help

A mortgage is a loan in which the person who makes the loan is referred to as the mortgagee, and they are protected from failure by the mortgager's collateral, which is defined in the mortgage deed. In other words, if the borrower fails to make loan payments, the creditor has the right to force the sale of the property and receive the revenues.

With our mortgage assignment help, you will get a complete overview of your subject matter via one-on-one guided learning sessions.

The above-explained concept is the regular mortgage structure that we are all acquainted with. Traditional mortgages are usually set for 15 or 30 years and demand a monthly payment. Most banks are required to collect and remit property taxes and homeowners' coverage on the part of their debtors to local governments.

As a result, most people's monthly payments consist of principles, interest, insurance, and taxes. Insurance and tax payments are held in an offset account until they are sent to the appropriate agency by the lender.

Online Assignment Help

Custom Essay Help

Dissertation Writing Guidance

Different Types of Mortgages You Need To Know Before Writing Your Assignments of Mortgage

Fixed-rate and adjustable-rate, which is sometimes also known as fluctuating rate mortgages, are the two most popular types of mortgages. Our mortgage assignment helps experts acquire well-versed knowledge of different types of mortgages, how to calculate rates, and everything.

Mortgages with a Fixed Rate

A fixed-rate mortgage provides clients with a fixed interest rate for a set period of time, usually 15 to 20 years. The larger monthly payment comes with a reasonable rate of interest and a shorter duration. In contrast, the monthly payback amount is longer for the borrower to pay.

The most significant benefit of a fixed mortgage is that the borrower can depend on the same monthly mortgage payment every month for the loan duration, making it easier to plan household budgets and prevent any unexpected additional expenses from month to month. The borrower is not required to make larger monthly payments even if marketplace rates rise dramatically.

Are you aware of all the recent updates related to mortgages? No? Buckle up, as you have to mention all this in your assignment as well. Don’t worry if you are not aware of them, our mortgage assignment help experts are there for you, especially for such pieces of knowledge, over guided learning sessions.

Adjustable-Rate Mortgages

Do you know that the rate of interest on adjustable-rate mortgages (ARMs) can alter during the life of the loan? Interest rates fluctuate with changes in market prices and other variables, affecting the level of interest a borrower must pay. The interest rate on adjustable-rate mortgages is reviewed and changed at regular intervals.

The 5/1 ARM, which has a fixed interest rate for the first five years of payments, is one of the most common adjustable-rate mortgages. The interest rate will be altered annually for the balance of the loan's term.

The concept of Adjustable rate mortgages is easy to understand yet tricky, and there’s a lot about the concept that you are not aware of right now in order to make your assignment. With the assistance of our Mortgage assignment help expert, you will be able to learn all the varied concepts of mortgage in detail.

ARMs are popular because they often have lower initial interest charges than fixed-rate mortgages, making it more challenging for borrowers to measure expenditures and develop monthly budgets. Borrowers who believe their income will increase over time may opt for an ARM to secure a low variable price while they are still earning less.

The main danger of an ARM is that rates of interest may rise dramatically over the course of the loan, to the extent that the mortgage costs would become too high for the borrower to afford. Significant rate hikes may result in delinquency and the borrower's home being repossessed through foreclosure.

Mortgages are significant financial obligations that bind borrowers to decades of continuous payments. On the other hand, most people think that the long-term advantages of homeownership justify taking out a mortgage.

Assignments on Mortgage Prepared by Our Experts

Want an A-Grade on Your Mortgage Assignment? Avail Our Help and Make It Possible!

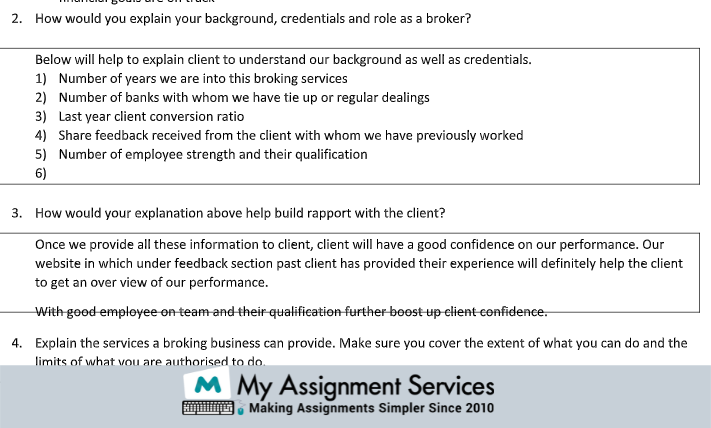

The sole purpose of My Assignment Services is to provide 101 assistance to students seeking Mortgage assignment assistance for a wide range of complex topics. Our goal is to give high-quality assignment writing help to boost your academic results. Our Mortgage assignment help expert has helped several students with top-notch quality taxation projects, allowing them to expand their knowledge on the subject.

24 X 7 Support

100+ Subjects Covered

2000+ Ph.D Experts

Apart from your Mortgage assignment writing help, here are the following benefits that you will get if you opt for our service:

- We provide live chat, phone, and email assistance 24/7. Reach out to us anytime.

- Our writing experts are highly qualified, experienced, and trained professionals with extensive expertise in addressing various projects’ problems.

- Our professionals give 100% original and plagiarism-free mortgage assignment help.

- Our taxation assignments are inexpensive, and you can easily obtain help from them at budgeted rates.

- We Consistently Meet the Deadlines for our tasks.

- Our papers are always of the finest quality, and we adhere to every university regulation.

- Our methods of online payment are safe and secure.

- Revisions are free and limitless.

- If you want assignment help in the USA within a limited time frame, contact us. We provide urgent assignment writing assistance.

- We will do your assignment help completely discreetly.

Got more doubts? Fill out the form at your right, and explore the website to learn more.

Get It Done! Today

1,212,718Orders

4.9/5Rating

5,063Experts

Highlights

- 21 Step Quality Check

- 2000+ Ph.D Experts

- Live Expert Sessions

- Dedicated App

- Earn while you Learn with us

- Confidentiality Agreement

- Money Back Guarantee

- Customer Feedback

Just Pay for your Assignment

Turnitin Report

$10.00Proofreading and Editing

$9.00Per PageConsultation with Expert

$35.00Per HourLive Session 1-on-1

$40.00Per 30 min.Quality Check

$25.00Total

Free- Let's Start

Other Subjects

Get

500 Words Free

on your assignment today